The Best Homeowners Insurance for Short-Term Rentals The Ascent

Table of Content

It offers the most comprehensive and specific coverage for vacation rentals at affordable rates in all 50 states. Short-term rental endorsements can be as low as $4 per month for about $10,000 worth of coverage for your personal belongings. An independent insurance agent can help you find exact quotes for short-term rental coverage in your area. The Airbnb phenomenon has changed the vacation rental and travel industry forever. Just 10 years ago, there were only 200,000 short-term rental properties in the U.S., primarily marketed via local property managers, now because of Airbnb, there are over 2,000,000. Virtually any property owner can advertise on Airbnb and instantly be competing with Hilton and Marriott for traveler’s lodging dollars.

We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next. “Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. While change has been constant over the years, our goal of maintaining relationships within our community and providing the standard of service expected from a hometown agency has stayed the same. Family Insurance Center continues to be a progressive, local agency placing a high value on the strong traditions we were built upon. Founded in 1938, American Modern issues policies in all 50 states from its headquarters in Cincinnati, Ohio, with an AM Best financial strength rating of A+ .

With A 3-Minute Quote

Proper Insurance acts as a business policy to provide comprehensive coverage for your building, contents, commercial liability, and business income. Additionally, we provide all of this coverage while simultaneously acting as a personal liability policy if the property “doubles” as your primary residence. One of the cheapest vacation rental insurance policies around, InsuraGuest offers exceptional coverage for damaged or stolen items. Hosts are covered up to $25,000 if valuables or the property has been damaged, and the same amount against accidental medical incidents on your property for your guests. Short-term rental insurance is generally only needed if you have paying guests in your home; it does not apply to family members or friends who are staying with you for free.

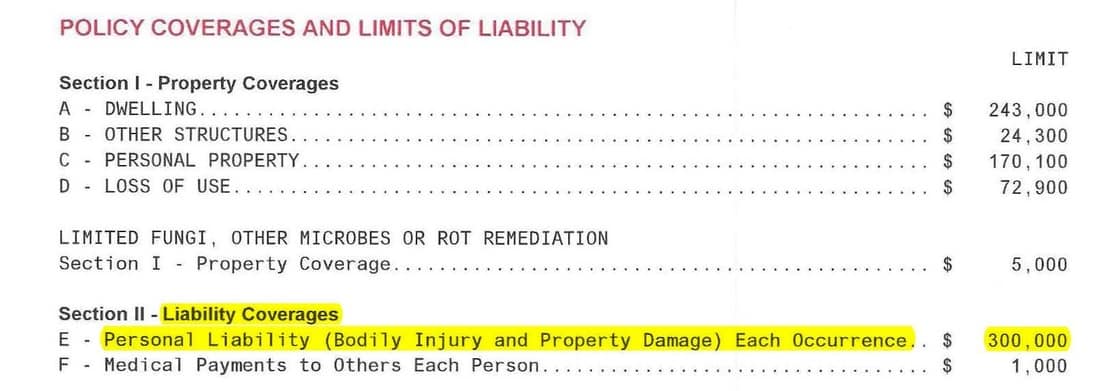

If you already have liability coverage for your rental unit, Vrbo’s liability insurance will be additional coverage. A short-term rental endorsement is around $50 for limited coverage up to $10,000 for personal belongings. It can be as low as $4 per month if you add it to your Allstate auto policy. Policy costs will vary depending on the location, size, age of the home, and how much guest medical or family liability coverage you want. Allstate landlord policies include coverage for dwellings, other structures on the property, vandalism, burglary, fair rental income, building codes, and liability.

studiomuc Frankfurt

If you are concerned with risks and want robust coverage, then a standalone policy may work for you. Just like a homeowners policy, damage from flood and earthquake is not included. Homeowners will need to consider getting additional coverage for flood or earthquake risk.

When it’s both your home and you rent it out to others, short-term rental insurance is important to consider. Let’s be clear, when you decide to use your home for short-term rental use, you are running a business. That means you can ultimately be found liable for any injury that may happen to one of your guests. Not to mention, if your guest injures others, because after all, you vetted them and allowed them to short-term rent your home. If someone is injured at your short-term vacation rental, chances are they will have big medical bills and pain and suffering. The next move is for them to hire an attorney and claim you liable for their injuries, regardless of fault.

How Insurance Fits Into Short-Term Rental Regulations

But if you prefer speaking to a live person, you can do that, too. American Modern is your best choice if you want hassle-free customer service. There are no standard occupancy restrictions, and it is available in all 50 states. For commercial and personal liability up to $2 million, the estimated rate would be roughly $1,600 annually. Over the past five years, the number of short-term rental home sharing users has increased significantly.

You can tailor your custom package to handle storm damage, a burst pipe, a guest’s injury, and the rent you lose while recovering from any of these setbacks. Nationwide will recommend you select additional coverage for flood or earthquake risk, depending on your rental property’s location. For the broadest range of insurance product options for your short-term rental, check Nationwide. You can even choose coverage beyond the home to include stolen items from your watercraft or vehicle that you may have at your rental property, making it the best for coverage options. Though many insurance companies could offer short-term rental coverage for you, finding it could also depend on the area you live in. Here are a few of the top companies for short-term rental coverage.

Airbnb Host Protection doesn’t cover your personal belongings or damage to your home. Many consumers simply shop on price as coverage’s can be very confusing. Most domestic insurer’s have national marketing campaigns built around saving consumers money if they switch. Investopedia requires writers to use primary sources to support their work.

Quotes are available online after providing some basic information, and homeowners can forward a copy of their quote to a local agent for the in-person experience. Prices are in the typical range of its competitors, between $1,000 and $3,000. If you plan to share your home with short-term renters, check out our favorite, Allstate. We like Allstate’s Host Advantage as an affordable way to add coverage for short-term rentals to existing homeowner policies and its powerhouse mobile app.

Your neighbor can file a claim for property damage under Host Protection Insurance. You will have to try to recover damage to your bathroom from the guest first. If the guest refuses to pay, you may be able to get reimbursement through Host Guarantee.

The single biggest exposure you have as a vacation rental owner is liability. When you open your door as the owner, you are also opening yourself up to liability risk. This liability risk is there whether you are simply renting a downstairs apartment or your entire property. What if a guest were to injure themselves while staying at your property? Maybe the shower was not thoroughly cleaned, and a guest slipped on soap scum? Or worse, the vacation rental caught fire and resulted in a guest’s death.

Comments

Post a Comment